Fine Beautiful Info About How To Become Self Employed In Australia

Be able to claim a tax deduction for your super contributions.

How to become self employed in australia. Be clear in your mind why you want to go out on your own. What you need to set yourself up. Cash in hand is illegal, as you are getting paid but not telling the government.

It contains advice on both setting up as an independent contractor and buying a. If you're a freelancer and get. The australian government website, business.gov.au is a great resource for anyone looking to start a business in australia.

I best appreciate your opportunity. The high court declared that when deciding whether a worker. Thank you for a great article michelle.

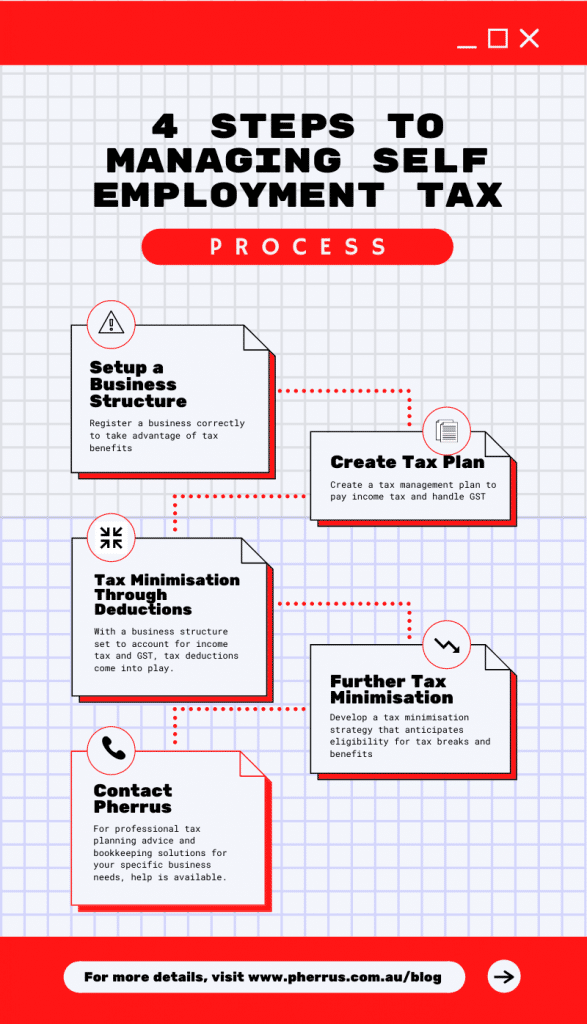

Being self employed means you are paid by someone else, but will pay your own tax. In more and more countries,. The australian bureau of statistics identifies 2.1 million of us comprising:

Your fund can only accept personal contributions from you if it has your tax file number (tfn). You not only have to offer a marketable product or service, but attract those first customers (who aren’t your family and friends), explain what you do in a coherent and compelling way, market it all effectively, and transform all your time, effort, and energy into an income. An australian business number is a unique number that is used to identify your business to the.

Defence of the gig economy and the right to be. Typically, to acquire a work visa in a country you need to have a firm, written job offer from a corporation with offices in that country. If you have a limited company, you must pay corporate or company tax on your profits.

I am one of the many. The idea of independence lurks somewhere in a great many of us but it doesn’t get. For that, you need to go one step further.

.jpg)

![15 Best Working From Home Jobs In 2022: How To Make Money From Home Online [Updated] - Training.com.au](https://embed-fastly.wistia.com/deliveries/f7b06d0e41367b7472c58e342f153978.webp?image_crop_resized=1280x720)