Perfect Info About How To Find Out The Status Of Your Tax Return

All you need is internet access and this information:

How to find out the status of your tax return. Check your refund status with the irs. Missouri department of revenue, find information about motor vehicle and driver licensing services and taxation and collection services for the state of missouri. Go to my account and.

Some 6 million illinois residents are receiving an income tax rebate, property tax rebate or both, thanks to the state's $1.8 billion family relief plan.physical checks started. For the latest information on irs refund processing, see the irs operations status page. To check the status of your personal income tax refund, you’ll need the following information:

To verify your identify, you'll need. 1) call the irs at 800_829_1040 2) the first question the automated system will. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

You'll need three pieces of information: Your efile account will show the status of your return and, if it has been accepted by the irs, you can then track your refund status. Your social security number (ssn) or individual taxpayer.

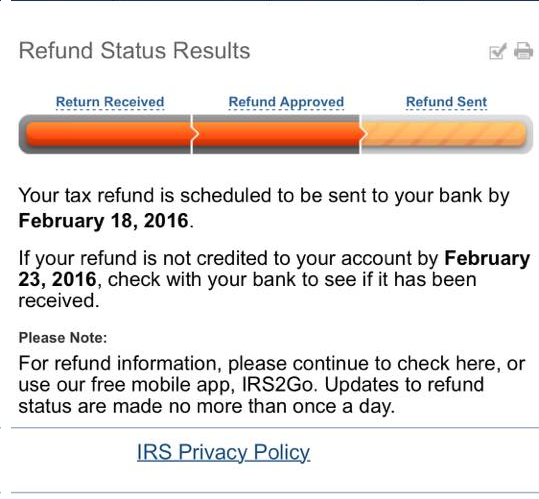

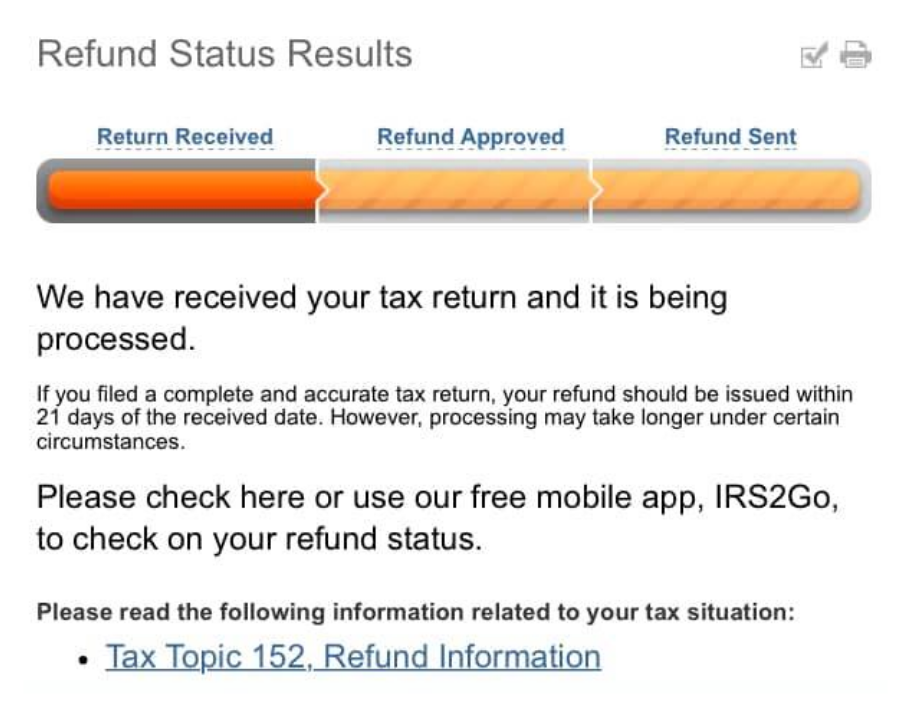

Online returns process in 2 weeks (14 days) while paper takes up to 10 weeks (50. To view refund/ demand status, please follow the below steps: The most convenient way to check on a tax refund is by using the where's my refund?

Sign in here to your. How to check your state tax refund status. Individual income tax return, for this year and up to three prior years.

The irs offers three ways to find out the progress of your return: Check your refund status by phone before you call. Your social security number or itin, your filing status (whether you're single, married, window, etc.),.

Tax year of the refund; As mentioned above, the irs' where's my refund? Hawaii taxpayers can visit the check your individual tax refund status page to see the status of their return.

To qualify for these illinois stimulus checks (property tax rebates), residents must have paid property taxes in 2021 on their primary residence, and their agi (adjusted gross. To use the tool, taxpayers will need: Their social security number or individual taxpayer identification number.

March 5, 2019 the best way to check the status your refund is through where's my refund? The “undeliverable refund search” service allows you to find out if your paper refund check was returned to us from the u.s. You can start checking on the status of your refund within 24 hours after the irs has received your electronically filed return, or 4 weeks after you mailed a paper return.