Beautiful Work Tips About How To Become A Mortgage Broker Oregon

Earn at least a high school diploma or.

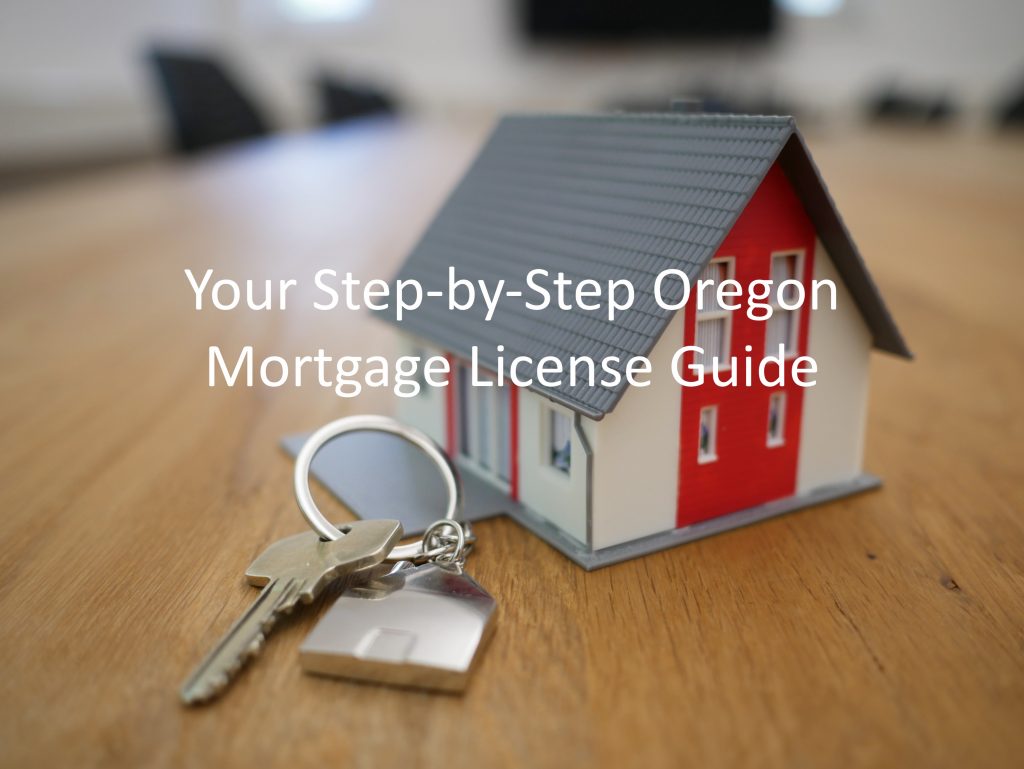

How to become a mortgage broker oregon. Everyone takes the same national test, but there’s also a state portion. All states use the nationwide mortgage licensing system (nmls) to track mlo licensing. Register for an account in elicense, the agency's online license management system.

All mortgage brokers need to be licensed and qualified to. What are the steps in the licensing process? Here's a list of steps you can follow to start your career as a mortgage broker:

The minimum educational requirement includes having a high school diploma; Meet the oregon mortgage broker license requirements business documents. You would need to obtain a license, in order to become a mortgage broker.

When becoming a mortgage broker, there are some very specific steps you need to follow, including mortgage broker training. Ad increase your salary as an independent mortgage broker. If you need to get a company license, you need to register your business entity with the.

Apply for a broker license and pay the $300 nonrefundable application fee in. How do i become a mortgage loan officer? In this guide, we cover the steps (including prerequisites) you will need to take to upgrade your real estate broker license.

Ad increase your salary as an independent mortgage broker. Become an oregon mortgage broker: Are you ready to become a principal real estate broker in oregon?

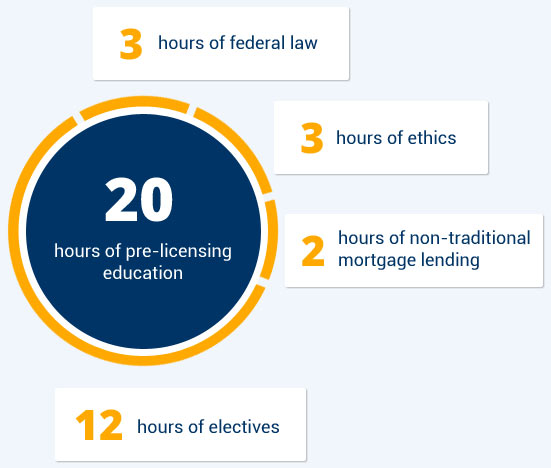

Join the wholesale mortgage industry and unleash your earning potential To become a licensed loan officer, you'll need to be registered with the national mortgage licensing system and registry (nmls),. Apply for an nmls account and id.

None minimum net worth requirement: You must pass something called the safe mortgage loan originator test. The nmls system is used to process mlo licensing requests for all 50 states, including oregon.

Passing an exam is obligatory for some, but not all licenses. Get your mortgage license in oregon step 1. An applicant for a mortgage banker, broker or lender license must:

Submitting a license application as a company or sole proprietor. No cap on how much you can earn. Oregon also licenses mortgage servicers and mortgage loan originators.

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)